Tax Talk: Mastering the Art of Handling Taxes in Freelance Payments

Tax Talk: Mastering the Art of Handling Taxes in Freelance Payments

Master the art of handling taxes as a freelancer with our comprehensive guide. Learn about online payment taxes, quarterly payments, and essential tips to stay organized and financially savvy.

If you’re like me, the word “taxes” probably makes you want to run for the hills. But here’s the thing: understanding how to handle taxes on your freelance income isn’t just important—it’s essential for your financial health and peace of mind. So, grab a cup of coffee (or tea, if that’s your thing), and let’s dive into the world of freelancer taxes!

The Freelance Tax Landscape: What You Need to Know

By James B from Team Paypipe

First things first: as a freelancer, you’re considered self-employed in the eyes of the tax authorities. This means you’re responsible for reporting all your income and paying taxes on it. But don’t worry, it’s not as scary as it sounds! Here’s a quick breakdown:

- Income Tax: You’ll pay this on your net earnings (that’s your total income minus your business expenses).

- Self-Employment Tax: This covers your Social Security and Medicare contributions.

- Estimated Quarterly Taxes: Instead of having taxes withheld from each paycheck like traditional employees, you’ll need to make quarterly tax payments.

Navigating Online Payment Taxes: The Digital Dilemma

In our increasingly digital world, chances are you’re receiving payments through various online platforms. Here’s what you need to know about online payment taxes:

- Reportable Income: Any money you receive for services rendered is considered taxable income, regardless of how it’s paid.

- Tax Forms: You will need to comply with local tax legislation and complete the forms required by your country of residence. e.g.1099 K forms in the US who have earned more than $600 from their employer within a calendar year.

- Record-Keeping: Keep detailed records of all your online transactions. This will be a lifesaver come tax time!

Your Freelancer Tax Guide: Tips and Tricks

Now that we’ve covered the basics, let’s look at some practical tips to make handling your taxes a breeze:

1. Separate Your Finances

Open a separate bank account for your freelance income. This makes it much easier to track your earnings and expenses.

2. Track Your Expenses

Keep receipts for all business-related expenses. These can be deducted from your taxable income, potentially saving you a bundle! An easy way to do this is by opening up a new Google Sheet and every time you get paid or pay an expense, simply write it down and the spreadsheet.

3. Set Aside Money for Taxes

A good rule of thumb is to set aside 25-30% of each payment you receive for taxes. This way, you won’t be caught short when it’s time to pay up.

4. Use Accounting Software

Invest in good accounting software to help you track income, expenses, and prepare for tax time. Many offer features specifically designed for freelancers.

5. Don’t Forget About Deductions

As a freelancer, you can deduct things like home office expenses, equipment, software subscriptions, and even a portion of your internet bill. Every little bit helps!

The Quarterly Tax Dance: Staying on Top of Payments

Remember those estimated quarterly taxes we mentioned earlier? Here’s a quick guide to help you stay on track:

- Due Dates: These vary depending on where you live, but in the USA, for example, the federal government requires taxes to be turned in by the April 15th deadline.

- Calculation: You can start a spreadsheet and begin to track your every expense each day, or you can sign up for a business bank account, which will do the same thing for you and save you some headache in the process.

- Payment Methods: You can pay online through the IRS website, by phone, or by mail.

When to Call in the Pros

While it’s entirely possible to handle your taxes on your own, sometimes it’s worth calling in a professional. Consider hiring a tax professional if:

- Your freelance income has significantly increased

- You’re unsure about deductions or how to report certain types of income

- You’re dealing with international clients and payments

- You simply want the peace of mind that comes with professional help

Wrapping It Up: Your Freelance Tax Toolkit

Handling taxes as a freelancer doesn’t have to be a nightmare. With the right knowledge and tools, you can tackle your taxes with confidence. Remember:

- Keep detailed records of all income and expenses

- Set aside money for taxes with each payment you receive

- Stay on top of your quarterly estimated tax payments

- Take advantage of all applicable deductions

- Don’t be afraid to seek professional help if you need it

By following this freelancer tax guide, you’ll be well on your way to mastering the art of handling taxes in your freelance payments. Remember, staying organized throughout the year is the key to stress-free tax seasons. Happy freelancing, and may your tax returns always be in your favor!

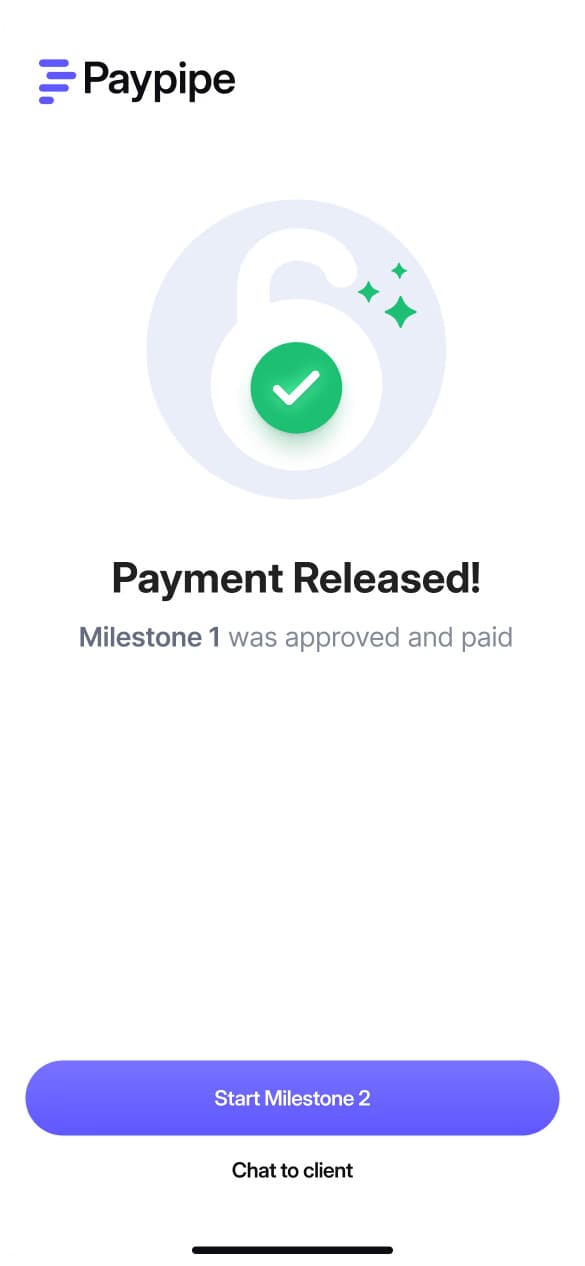

Protecting Your Earnings: How Smarter Payment Processes Reduce Scam Risks

In the digital age, the convenience of working online comes with its own set of challenges. Among the most serious? Scams that target contractors and freelancers by exploiting weaknesses in payment processes. The good news is that these risks can be reduced often by making a few smart adjustments to how you handle offers, approvals, […]

How to Protect Yourself from Payment Scams as a Contractor or Freelancer

The Reality of Payment Scams in Contract Work If you’ve been freelancing or contracting for any length of time, you’ve probably heard of or even experienced a payment situation that didn’t feel right. One common story? A new contractor lands a dream client who pays a large sum upfront. Soon after, the payment platform flags […]

Breaking the Late Payment Cycle: Practical Strategies for Small Businesses

Late payments are one of the biggest challenges small businesses face. They disrupt cash flow, strain client relationships, and create unnecessary stress. If you’ve ever waited weeks or even months for an invoice to be paid, you know how frustrating it can be. The good news? You can take proactive steps to reduce delays and […]

Future-Proofing Your Business: Why Smarter Payment Processes Pay Off Long-Term

In business, the way you get paid isn’t just an operational detail, it’s a foundation for stability, growth, and long-term success. While many small businesses focus heavily on improving their products or services, the systems that handle payments are often left unchanged for years. That’s a missed opportunity. The reality? Client expectations are shifting faster […]

The Future of Payments: Trends Shaping How Businesses Get Paid Worldwide

Did you know that in some countries, payments now clear in under 5 seconds? Payment technology is evolving faster than ever and it’s completely changing the way businesses get paid. For small business owners, contractors, and service providers, understanding these payment trends isn’t just a matter of keeping up with technology. It’s about preparing for […]

How to Prevent Payment Delays in Service-Based Work: Practical Tips for Faster Project Completion

For many service-based businesses whether you’re a tradie, creative professional, consultant, or contractor payment delays can be more than an inconvenience. They can disrupt cash flow, slow down project delivery, and damage client relationships. The good news is, there are practical, straightforward strategies you can use to prevent these delays, keep projects moving, and maintain […]

How Contractors & Home Services Providers Use Paypipe.io to Impress Clients and Keep Them Coming Back

In the world of contracting and home services, your reputation is everything. Clients are not only looking for quality work they’re looking for clear communication, reliable timelines, and hassle-free payments. The more seamless the experience, the more likely they are to hire you again and recommend you to friends, family, or neighbours. That’s where Paypipe.io […]

How Small Businesses Can Use Paypipe.io to Manage Offers, Track Payments, and Stay on Top of Everything

Running a small business can feel like a juggling act. You’re managing client relationships, organising schedules, sending offers, following up with customers and somehow still trying to get paid on time. The challenge isn’t just about keeping the business afloat; it’s about staying organised without spending your entire day chasing paperwork or overdue invoices. That’s […]

How AI Helps New Freelancers Save Time and Stress Drafting Offers and Contracts

You’ve landed your first freelance client. The hard part finding someone who believes in your skills is done. You’re excited to get started, but then comes the email: “Could you send me your offer and contract to review?” This is where many freelancers freeze. What should you write? What terms need to be there? What […]

Why Freelancers Should Never Chase Payments Again

You sent the invoice two weeks ago. Nothing. You follow up politely. Still nothing. The rent is due, the bills are piling up, and the client is nowhere to be found. This is not rare. A 2023 study by the Independent Contractors Association found that nearly three out of four freelancers in Australia have experienced […]

Why Contractors & Home Service Pros Should Showcase Their Work Online

Being a contractor or home service professional in Australia means competing in a busy, competitive market. Whether you’re a builder, plumber, electrician, painter, landscaper, or handyman, the challenge is the same: proving to potential clients that you can be trusted to deliver good work. And in today’s digital-first world, word-of-mouth alone is no longer enough. […]

Why SMBs Should Build a Public Page Clients Can Actually Trust

Running a small or medium-sized business (SMB) in Australia has never been easy, and in today’s digital-first economy, it comes with even more challenges. One of the biggest issues facing SMBs is credibility. Clients are more cautious than ever about who they work with, and in many industries, they have no shortage of options. In […]

Why Your Portfolio Should Do More Than Look Pretty

By Queen Valbuena For many freelancers, their portfolio is their pride and joy, showcasing beautiful designs, clever copy, or impressive projects. But here’s the problem: most portfolios stop at admiration. They don’t move clients to take action. In today’s competitive market, simply impressing visitors is no longer enough. You need your portfolio to guide potential […]

Why Freelancers Need More Than Social Media: Build a Portfolio That Wins Clients

By Queen Valbuena, digital marketing consultant Queen helps freelancers and creatives build professional online presences and attract better clients. By moving her portfolio from Instagram to Paypipe.me, she increased her proposal acceptance rate by 42% in three months. Why Professionalism Matters More Than Ever Freelancing today is as much about trust as it is about […]

Making Invoicing Easier for Freelancers

Discover how freelancers can simplify their invoicing process with automation and efficiency tips. Learn to streamline payments, leverage AI, and utilize cloud-based solutions for better cash flow and time management.

Tools and Techniques for Efficient Project Management

Discover essential project management tools and techniques for freelancers. Learn how to boost productivity, streamline workflows, and deliver exceptional results with Paypipe and other key resources.

AI Tools to Help Freelancers Run and Grow Their Business

Discover the top AI tools helping freelancers boost productivity and grow their business in 2024. From project management to financial tools, learn how to leverage AI for success.

Integrating Advanced Payment Systems for Freelancers

Discover how integrating advanced payment systems can streamline financial operations, reduce costs, and enhance security for freelancers. Learn about the benefits of seamless technology integration and how platforms like Paypipe are revolutionizing the freelance economy.

Cutting Costs: How Freelancers Can Reduce Payment Fees with Paypipe

Discover how freelancers can reduce payment fees with effective strategies and the help of Paypipe’s low fees and freemium model. Learn how to save more and simplify your payment process in 2024.

Best Practices for Freelancers to Secure Their Earnings

Discover essential tips for freelancers to protect their earnings, ensure timely payments, and avoid common pitfalls. Learn how tools like Paypipe can streamline and secure your freelance transactions.

The Future of Payment Security and The Rise of Cryptocurrency

Discover why cryptocurrency is transforming the future of digital payments. Learn about the benefits of crypto transactions—speed, security, and global accessibility—and how Paypipe is staying ahead by enabling seamless, escrow-backed crypto payments with Zero Dispute Liability.

Expanding Payment Horizons: Paypipe Launches in Pakistan

Paypipe launches in Pakistan, offering freelancers and small businesses secure payment processing, professional tools, and global reach. Discover how Pakistani professionals can streamline their independent work with comprehensive project management and payment solutions.

Using Performance Marketing for Measurable Success as a Freelancer

Unlock the power of performance marketing as a freelancer. Learn actionable digital strategies to boost your ROI and measure your success. Perfect for ambitious freelancers ready to level up their marketing game.

High-End Marketing: How to Attract High-Value Customers

Learn the secrets of luxury marketing and how to attract high-value consumers for your premium products. Discover strategies to position your brand and engage affluent customers.

Leveraging Social Media for Business Growth: Strategies for Freelancers and Small Businesses

Discover proven strategies to leverage social media marketing for growing your freelance or small business. Boost brand awareness and engagement with our expert tips.

Top Channels for Growth Marketing: Driving Business Expansion

Discover the top channels for growth marketing as a freelancer or small business owner. From social media advertising to referral programs, learn proven strategies to drive measurable business expansion and streamline your finances with Paypipe.

Mastering the Art of Client Acquisition: Proven Strategies for Freelancers

Discover proven client acquisition and marketing strategies to grow your freelance business. Learn how to attract high-quality clients and boost your income.

Effective Networking Strategies for Freelancers

Network like a pro: Strategies to build valuable connections and secure more gigs

Using Digital Marketing to Grow Your Freelance Business

Discover how freelancers can leverage digital marketing strategies like SEO, social media, content marketing, and paid advertising to attract more clients, increase revenue, and build a thriving business. Learn tips for optimizing your online presence and simplifying payments with Paypipe.

Streamlining Your Freelance Operations: A Guide to Operational Efficiency

Discover key strategies for streamlining your freelance operations and boosting business efficiency. Learn how to leverage technology, manage projects effectively, and optimize your workflow for greater productivity and profitability.

Tools and Techniques for Efficient Project Management

Discover essential project management tools and techniques for freelancers. Learn how to boost productivity, streamline workflows, and deliver exceptional results with Paypipe and other key resources.

The Best Time Management Tools for Freelancers

Discover the top time management tools for freelancers. Learn how Trello, RescueTime, and Toggl can boost your productivity and efficiency. Plus, see how Paypipe complements these tools for freelancing success.

5 Tips for Stronger Cash Flow as a Freelancer

Discover 5 essential tips for freelancers to boost cash flow using smart payment platforms, robust invoicing systems, real-time tracking, streamlined communication, and multi-currency strategies. Learn how Paypipe can help optimize your freelance finances

Tax Talk: Mastering the Art of Handling Taxes in Freelance Payments

Master the art of handling taxes as a freelancer with our comprehensive guide. Learn about online payment taxes, quarterly payments, and essential tips to stay organized and financially savvy.

Dealing with Delays: Managing the Impact of Slow Payments for Freelancers

Learn effective strategies to manage the impact of slow payments with secure payments, freelancer tools, and optimized payment processing. Discover how platforms like Paypipe can help ensure swift and hassle-free transactions.