Best Practices for Freelancers to Secure Their Earnings

Best Practices for Freelancers to Secure Their Earnings

Discover essential tips for freelancers to protect their earnings, ensure timely payments, and avoid common pitfalls. Learn how tools like Paypipe can streamline and secure your freelance transactions.

Hey there! I’m Abir, an SEO content specialist and marketing manager who’s been freelancing for the past 12 years.

Let me paint you a picture—imagine completing an intense project, pouring your heart and soul into it, and then… nothing. Your client vanishes, your payment never arrives, and you’re left feeling frustrated and helpless. Sound familiar?

If you’ve been in the freelance game for a while, you know that getting paid isn’t always a walk in the park. From chasing down payments to dealing with fraud, it can be a real headache. I’ve been there, and I’ve learned a thing or two along the way.

I’m here to share some tried-and-true tips to help you protect yourself and ensure you get paid for your hard work especially if you are either new to freelancing or thinking about getting started. And, I’ll share with you a new tool I’ve recently discovered that makes life so much easier—but more on that later.

1. Use Written Contracts

First things first, always use a written contract. I can’t stress this enough. A solid contract outlines the scope of work, payment terms, deadlines, and dispute resolution mechanisms. Think of it as your safety net.

Personal Note: Early in my career, I once took on a project based on a verbal agreement. Big mistake. When the client started changing the project scope, I had no written terms to fall back on. Lesson learned.

My observations:

- Email/PDF Contracts: Easy to create and send. However, they can be altered or lost if not managed properly.

- Contract Management Software (e.g., DocuSign): Secure and professional but can be expensive.

2. Request Upfront Payments or Deposits

Asking for an upfront payment or a deposit shows that your client is serious and committed. It’s a great way to cover initial costs and ensure the client has some skin in the game. It may be a cause of concern for your client however as some may be worried about security and scams.

Personal Note: I once skipped this step, thinking I could trust a referral client. I ended up chasing the payment for months. Never again.

My observations:

- PayPal: Widely used and trusted, but high fees and potential for chargebacks.

- Bank Transfers: Secure but not always possible for international clients.

- Client Confidence: It takes effort to build this and make sure your client is happy to send money upfront.

3. Invoice Promptly and Clearly

Send your invoices as soon as the work is done. Make them detailed but easy to understand. Include your contact information, a breakdown of services, the amount due, and the payment deadline.

Personal Note: I used to delay sending invoices, thinking clients would appreciate the flexibility. Turns out, prompt invoicing often leads to prompt payment while it is still on my client’s radar.

My observations:

- Invoicing Software: Great for creating professional invoices, but comes with a monthly fee which doesn’t allow for flexibility based on my workload.

- Manual Invoicing: Free but time-consuming and easy to make mistakes.

4. Avoid Working for Free

Some clients might ask for a free sample or a test job so they can see your work before committing. While a small sample can sometimes be reasonable, be wary of doing too much work without getting paid. Your time is valuable.

Personal Note: I learned to set clear boundaries after a potential client asked for extensive free work and then disappeared. I’ve since published an online portfolio so my clients can see my work upfront.

My observations:

- Portfolio Websites (e.g., Behance): Showcases your work without giving it away, but might not capture all the client’s needs. It’s also an additional tool to keep track of.

- Freelance Platforms (e.g., Upwork): Provide structure and exposure but take a significant cut of your hard-earned pay.

5. Use Secure Payment Methods

Using secure payment methods is critical to making sure you get paid and your clients’ security is taken care of. Avoid unfamiliar or unverified methods that could jeopardize your earnings. Stick to trusted platforms that offer robust security features.

Personal Note: I feel better when I can engage with my client on a platform where we can both feel secure and comfortable. My clients don’t need to worry about their personal information being at risk.

My observations:

- PayPal: Secure and widely accepted but high fees mean I lose money.

- Stripe: Great for international payments but requires technical setup if using directly.

6. Keep Detailed Records

Maintain detailed records of all communications, contracts, invoices, and payments. These records are invaluable if a dispute arises.

Personal Note: I use cloud storage to keep everything organized and accessible. It’s saved me more than once in disputes. I even paste the conversations I have with clients across multiple platforms which is time-consuming!

My observations:

- Google Drive: Free and accessible but requires manual organization and a lot of copy/paste from other tools.

- Dedicated Project Management Tools (e.g., Asana): Great for organization but can be overkill for smaller projects and I still need to manually track conversations.

7. Be Prepared to Enforce Your Contract

If a client refuses to pay, be prepared to enforce your contract. This might involve seeking legal advice or using a collections agency. While this should be a last resort, knowing your rights can help you recover your earnings.

Personal Note: I try to familiarize myself with all the options that might be available to me, including the dispute resolution process of the tools I use.

My observations:

- Legal Services (e.g., LegalZoom): Offers professional help but can be expensive.

- Collections Agencies: Effective but takes a percentage of recovered funds.

8. Consider Business Insurance

Business insurance can protect you against non-payment and other risks. It’s an extra layer of security that can provide peace of mind.

Personal Tip: I sleep better knowing I have coverage for those “just in case” moments. It’s not just about the money but also about peace of mind.

What I’ve learned…

- Freelancer Insurance Providers (e.g., Hiscox): Provides tailored coverage but can be pricey.

- General Business Insurance: Offers broader coverage but might not cover specific freelance risks.

And Now, About That Cool Tool…

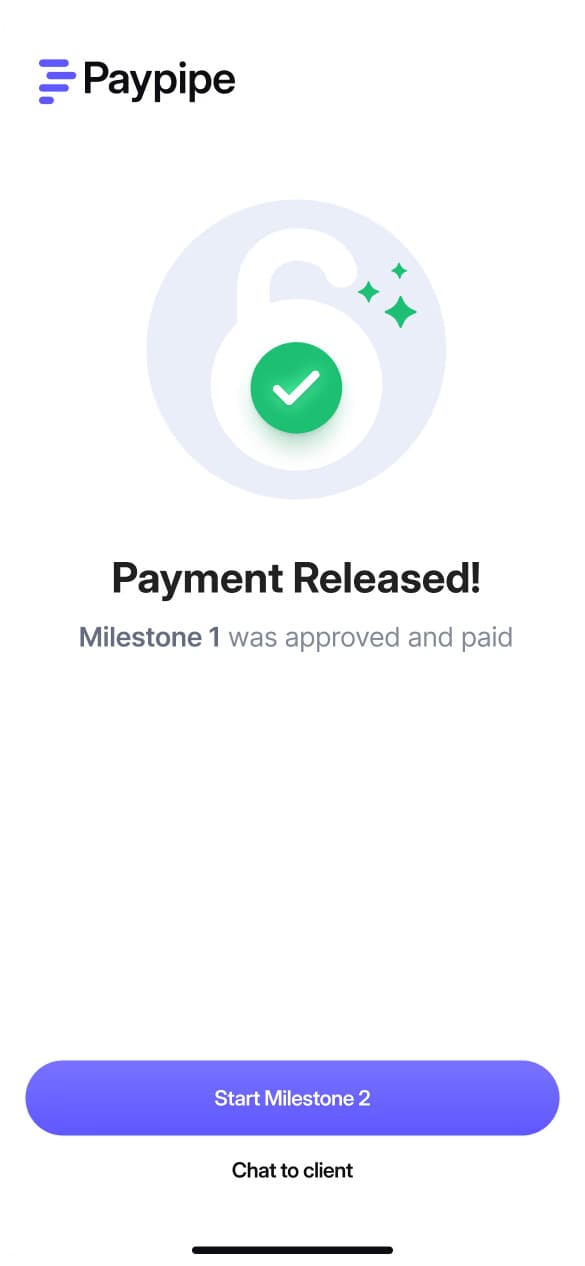

So, about that tool I mentioned earlier. It’s called Paypipe, and it’s been a game-changer for me recently. Here’s how it helps streamline and secure the payment process:

- Encrypted Payments: Paypipe uses advanced encryption techniques to safeguard your payment data, preventing unauthorized access and fraud.

- Guaranteed Payments: Paypipe holds the money exchanged between your client and you securely until the job is done. This way you know you’ll be paid for the work that you do.

- Secure Contract Management: Paypipe securely manages all your contracts, ensuring they are accessible only to you and your clients.

- Streamlined Communications: Paypipe centralizes all communications, ensuring secure and organized job discussions and document exchanges with your client are stored in one place.

- Automated jobs and payment: Paypipe automates your job process from creating an offer to getting paid.

ICYMI, I’ve learnt a lot on my journey and know exactly what I need to make my work life easier. By using Paypipe, I’ve found that I can focus more on delivering great work and less on worrying about the security of my transactions and communications. It’s not just a tool—it’s going to be the new partner in my freelance journey.

Final Thoughts

There’s a lot to think about when you’re a freelancer, or any other type of independent worker. From getting paid on time, to client confidence, to security and automation – it’s all on you to figure out! With tools like Paypipe, you can simplify and secure your job and payment processes, ensuring you get paid on time and in full for every project with ease. Give it a try and see how it can transform your freelance business.

Stay proactive, protect your work, and ensure that every transaction is as secure as possible.

Protecting Your Earnings: How Smarter Payment Processes Reduce Scam Risks

In the digital age, the convenience of working online comes with its own set of challenges. Among the most serious? Scams that target contractors and freelancers by exploiting weaknesses in payment processes. The good news is that these risks can be reduced often by making a few smart adjustments to how you handle offers, approvals, […]

How to Protect Yourself from Payment Scams as a Contractor or Freelancer

The Reality of Payment Scams in Contract Work If you’ve been freelancing or contracting for any length of time, you’ve probably heard of or even experienced a payment situation that didn’t feel right. One common story? A new contractor lands a dream client who pays a large sum upfront. Soon after, the payment platform flags […]

Breaking the Late Payment Cycle: Practical Strategies for Small Businesses

Late payments are one of the biggest challenges small businesses face. They disrupt cash flow, strain client relationships, and create unnecessary stress. If you’ve ever waited weeks or even months for an invoice to be paid, you know how frustrating it can be. The good news? You can take proactive steps to reduce delays and […]

Future-Proofing Your Business: Why Smarter Payment Processes Pay Off Long-Term

In business, the way you get paid isn’t just an operational detail, it’s a foundation for stability, growth, and long-term success. While many small businesses focus heavily on improving their products or services, the systems that handle payments are often left unchanged for years. That’s a missed opportunity. The reality? Client expectations are shifting faster […]

The Future of Payments: Trends Shaping How Businesses Get Paid Worldwide

Did you know that in some countries, payments now clear in under 5 seconds? Payment technology is evolving faster than ever and it’s completely changing the way businesses get paid. For small business owners, contractors, and service providers, understanding these payment trends isn’t just a matter of keeping up with technology. It’s about preparing for […]

How to Prevent Payment Delays in Service-Based Work: Practical Tips for Faster Project Completion

For many service-based businesses whether you’re a tradie, creative professional, consultant, or contractor payment delays can be more than an inconvenience. They can disrupt cash flow, slow down project delivery, and damage client relationships. The good news is, there are practical, straightforward strategies you can use to prevent these delays, keep projects moving, and maintain […]

How Contractors & Home Services Providers Use Paypipe.io to Impress Clients and Keep Them Coming Back

In the world of contracting and home services, your reputation is everything. Clients are not only looking for quality work they’re looking for clear communication, reliable timelines, and hassle-free payments. The more seamless the experience, the more likely they are to hire you again and recommend you to friends, family, or neighbours. That’s where Paypipe.io […]

How Small Businesses Can Use Paypipe.io to Manage Offers, Track Payments, and Stay on Top of Everything

Running a small business can feel like a juggling act. You’re managing client relationships, organising schedules, sending offers, following up with customers and somehow still trying to get paid on time. The challenge isn’t just about keeping the business afloat; it’s about staying organised without spending your entire day chasing paperwork or overdue invoices. That’s […]

How AI Helps New Freelancers Save Time and Stress Drafting Offers and Contracts

You’ve landed your first freelance client. The hard part finding someone who believes in your skills is done. You’re excited to get started, but then comes the email: “Could you send me your offer and contract to review?” This is where many freelancers freeze. What should you write? What terms need to be there? What […]

Why Freelancers Should Never Chase Payments Again

You sent the invoice two weeks ago. Nothing. You follow up politely. Still nothing. The rent is due, the bills are piling up, and the client is nowhere to be found. This is not rare. A 2023 study by the Independent Contractors Association found that nearly three out of four freelancers in Australia have experienced […]

Why Contractors & Home Service Pros Should Showcase Their Work Online

Being a contractor or home service professional in Australia means competing in a busy, competitive market. Whether you’re a builder, plumber, electrician, painter, landscaper, or handyman, the challenge is the same: proving to potential clients that you can be trusted to deliver good work. And in today’s digital-first world, word-of-mouth alone is no longer enough. […]

Why SMBs Should Build a Public Page Clients Can Actually Trust

Running a small or medium-sized business (SMB) in Australia has never been easy, and in today’s digital-first economy, it comes with even more challenges. One of the biggest issues facing SMBs is credibility. Clients are more cautious than ever about who they work with, and in many industries, they have no shortage of options. In […]

Why Your Portfolio Should Do More Than Look Pretty

By Queen Valbuena For many freelancers, their portfolio is their pride and joy, showcasing beautiful designs, clever copy, or impressive projects. But here’s the problem: most portfolios stop at admiration. They don’t move clients to take action. In today’s competitive market, simply impressing visitors is no longer enough. You need your portfolio to guide potential […]

Why Freelancers Need More Than Social Media: Build a Portfolio That Wins Clients

By Queen Valbuena, digital marketing consultant Queen helps freelancers and creatives build professional online presences and attract better clients. By moving her portfolio from Instagram to Paypipe.me, she increased her proposal acceptance rate by 42% in three months. Why Professionalism Matters More Than Ever Freelancing today is as much about trust as it is about […]

Making Invoicing Easier for Freelancers

Discover how freelancers can simplify their invoicing process with automation and efficiency tips. Learn to streamline payments, leverage AI, and utilize cloud-based solutions for better cash flow and time management.

Tools and Techniques for Efficient Project Management

Discover essential project management tools and techniques for freelancers. Learn how to boost productivity, streamline workflows, and deliver exceptional results with Paypipe and other key resources.

AI Tools to Help Freelancers Run and Grow Their Business

Discover the top AI tools helping freelancers boost productivity and grow their business in 2024. From project management to financial tools, learn how to leverage AI for success.

Integrating Advanced Payment Systems for Freelancers

Discover how integrating advanced payment systems can streamline financial operations, reduce costs, and enhance security for freelancers. Learn about the benefits of seamless technology integration and how platforms like Paypipe are revolutionizing the freelance economy.

Cutting Costs: How Freelancers Can Reduce Payment Fees with Paypipe

Discover how freelancers can reduce payment fees with effective strategies and the help of Paypipe’s low fees and freemium model. Learn how to save more and simplify your payment process in 2024.

Best Practices for Freelancers to Secure Their Earnings

Discover essential tips for freelancers to protect their earnings, ensure timely payments, and avoid common pitfalls. Learn how tools like Paypipe can streamline and secure your freelance transactions.

The Future of Payment Security and The Rise of Cryptocurrency

Discover why cryptocurrency is transforming the future of digital payments. Learn about the benefits of crypto transactions—speed, security, and global accessibility—and how Paypipe is staying ahead by enabling seamless, escrow-backed crypto payments with Zero Dispute Liability.

Expanding Payment Horizons: Paypipe Launches in Pakistan

Paypipe launches in Pakistan, offering freelancers and small businesses secure payment processing, professional tools, and global reach. Discover how Pakistani professionals can streamline their independent work with comprehensive project management and payment solutions.

Using Performance Marketing for Measurable Success as a Freelancer

Unlock the power of performance marketing as a freelancer. Learn actionable digital strategies to boost your ROI and measure your success. Perfect for ambitious freelancers ready to level up their marketing game.

High-End Marketing: How to Attract High-Value Customers

Learn the secrets of luxury marketing and how to attract high-value consumers for your premium products. Discover strategies to position your brand and engage affluent customers.

Leveraging Social Media for Business Growth: Strategies for Freelancers and Small Businesses

Discover proven strategies to leverage social media marketing for growing your freelance or small business. Boost brand awareness and engagement with our expert tips.

Top Channels for Growth Marketing: Driving Business Expansion

Discover the top channels for growth marketing as a freelancer or small business owner. From social media advertising to referral programs, learn proven strategies to drive measurable business expansion and streamline your finances with Paypipe.

Mastering the Art of Client Acquisition: Proven Strategies for Freelancers

Discover proven client acquisition and marketing strategies to grow your freelance business. Learn how to attract high-quality clients and boost your income.

Effective Networking Strategies for Freelancers

Network like a pro: Strategies to build valuable connections and secure more gigs

Using Digital Marketing to Grow Your Freelance Business

Discover how freelancers can leverage digital marketing strategies like SEO, social media, content marketing, and paid advertising to attract more clients, increase revenue, and build a thriving business. Learn tips for optimizing your online presence and simplifying payments with Paypipe.

Streamlining Your Freelance Operations: A Guide to Operational Efficiency

Discover key strategies for streamlining your freelance operations and boosting business efficiency. Learn how to leverage technology, manage projects effectively, and optimize your workflow for greater productivity and profitability.

Tools and Techniques for Efficient Project Management

Discover essential project management tools and techniques for freelancers. Learn how to boost productivity, streamline workflows, and deliver exceptional results with Paypipe and other key resources.

The Best Time Management Tools for Freelancers

Discover the top time management tools for freelancers. Learn how Trello, RescueTime, and Toggl can boost your productivity and efficiency. Plus, see how Paypipe complements these tools for freelancing success.

5 Tips for Stronger Cash Flow as a Freelancer

Discover 5 essential tips for freelancers to boost cash flow using smart payment platforms, robust invoicing systems, real-time tracking, streamlined communication, and multi-currency strategies. Learn how Paypipe can help optimize your freelance finances

Tax Talk: Mastering the Art of Handling Taxes in Freelance Payments

Master the art of handling taxes as a freelancer with our comprehensive guide. Learn about online payment taxes, quarterly payments, and essential tips to stay organized and financially savvy.

Dealing with Delays: Managing the Impact of Slow Payments for Freelancers

Learn effective strategies to manage the impact of slow payments with secure payments, freelancer tools, and optimized payment processing. Discover how platforms like Paypipe can help ensure swift and hassle-free transactions.