In today's fast-paced freelance world, managing payments efficiently is crucial for maintaining a steady cash flow and ensuring client satisfaction. As freelancers juggle multiple projects and clients, automating payment processes becomes not just an option, but a necessity. This guide explores how payment automation, powered by cutting-edge technology, can enhance efficiency in your freelance business.

Understanding Payment Automation

Payment automation refers to the use of technology to streamline and manage the payment process without manual intervention. By leveraging automation tools, freelancers can save time, reduce errors, and improve their financial management. This technology-driven approach allows freelancers to focus more on delivering quality work and less on administrative tasks.

Benefits of Payment Automation

Increased Efficiency: Automation reduces the time spent on invoicing and tracking payments, allowing freelancers to dedicate more time to their core tasks.

Reduced Errors: Automated systems minimize the risk of human errors in calculations and payment processing, ensuring accuracy and reliability.

Improved Cash Flow: With automated reminders and follow-ups, clients are more likely to pay on time, leading to a more consistent income stream.

Enhanced Client Experience: Providing clients with a seamless payment experience reflects professionalism and can lead to repeat business.

Implementing Payment Automation

For freelancers looking to integrate payment automation into their workflow, the following steps can serve as a guide:

Choose the Right Tools: Select a payment platform that offers automation features tailored to your needs. Important considerations include ease of use, integration capabilities, and cost-effectiveness.

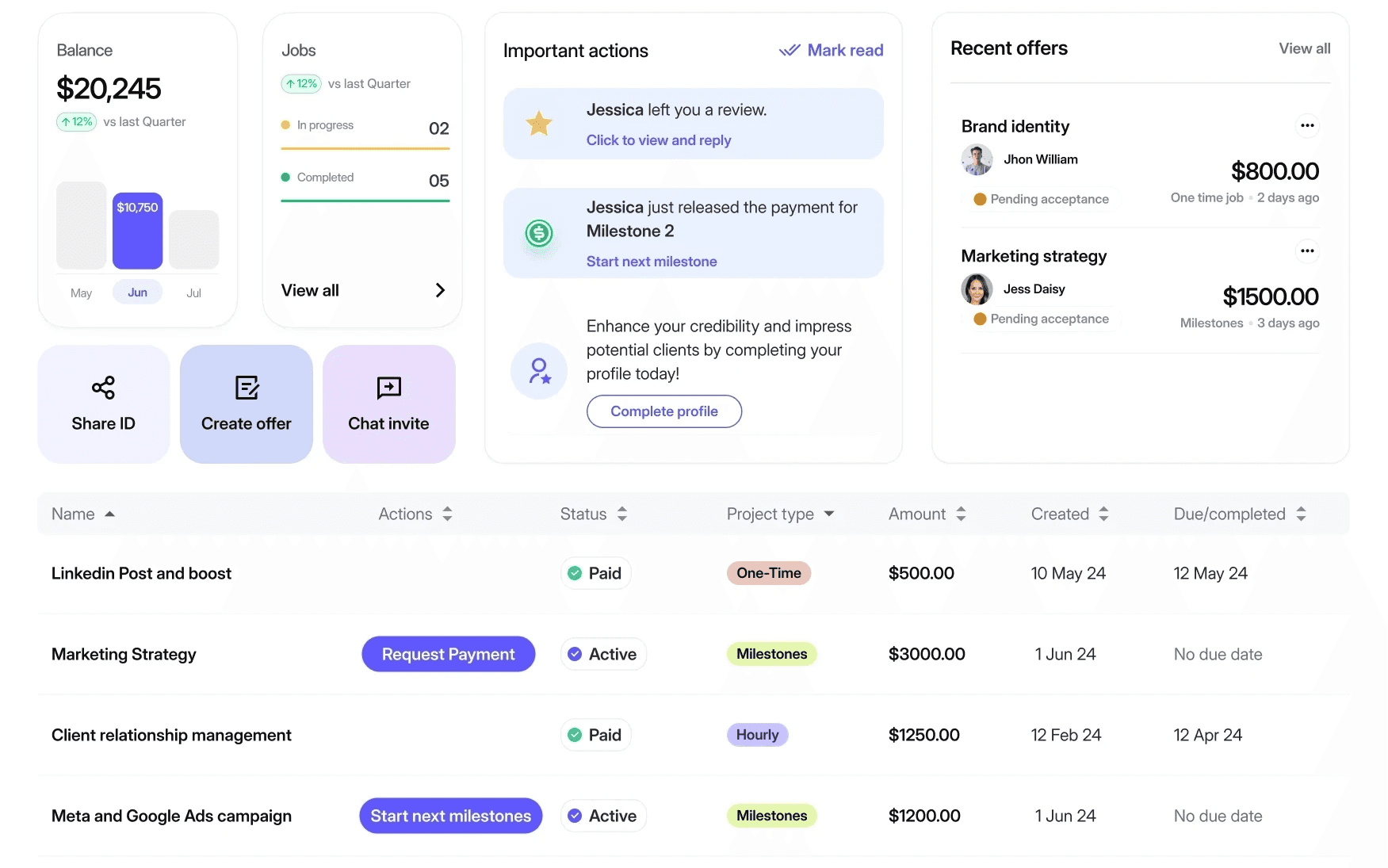

Enable Payment Tracking: Utilize tools that provide real-time tracking of payments, allowing you to monitor the status of each transaction and follow up promptly if needed.

Streamline Client Communication: Use platforms that integrate communication and payment processes, making it easier to manage client interactions and resolve any issues quickly.

Optimizing Your Workflow with Technology

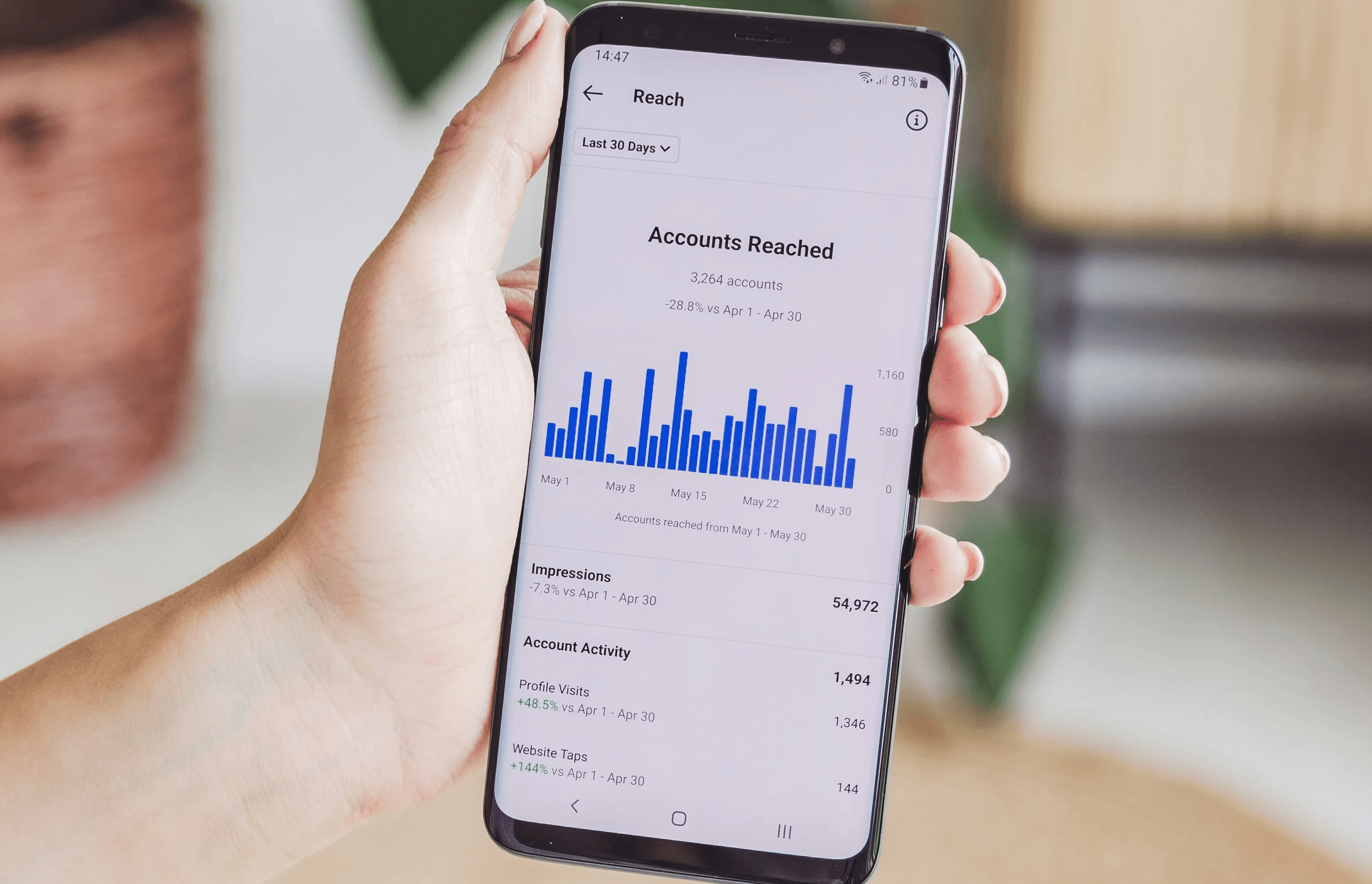

Technology plays a pivotal role in payment automation, offering advanced features that enhance efficiency. Many platforms support multi-currency transactions, automated reconciliation, and integration with accounting software, simplifying your financial management.

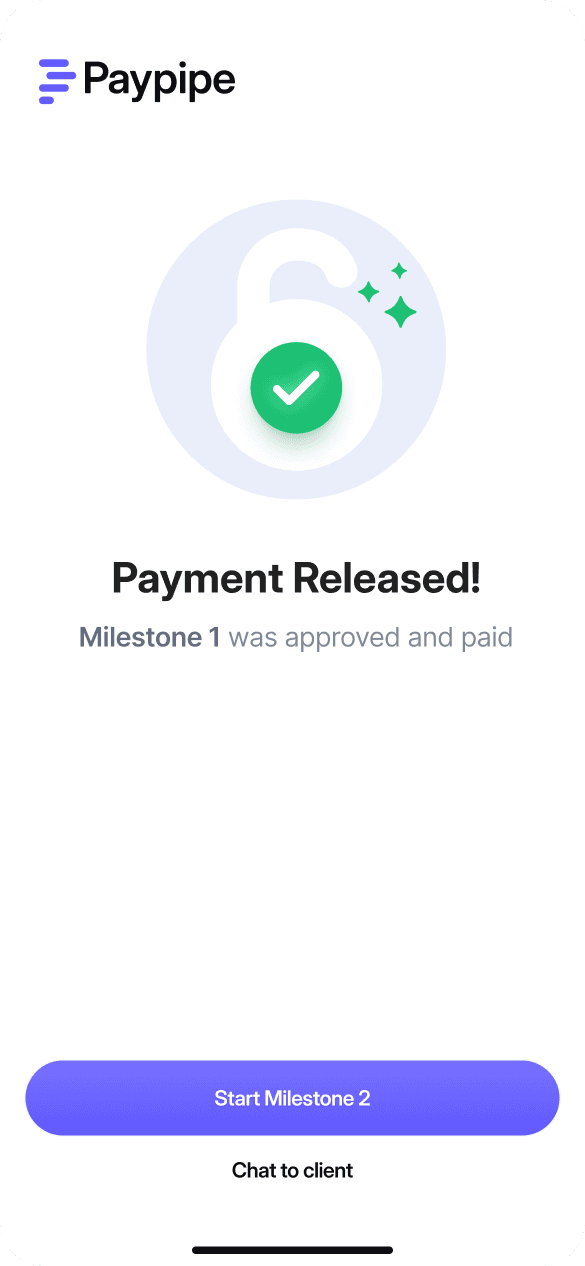

Paypipe: Your Partner in Payment Automation

Paypipe stands out as a leading solution for freelancers, offering a comprehensive suite of tools designed to automate and streamline payments. With competitive fees and robust security measures, Paypipe ensures that freelancers can focus on their craft while managing their finances effortlessly.

Paypipe's user-friendly interface and advanced features like real-time payment tracking and automated invoicing make it an ideal choice for freelancers seeking to enhance their payment processes.

Conclusion

As you can tell, automating your payment processes can have more than a few benefits when it comes to your freelance career. In my opinion, one of the most difficult parts of the freelance lifestyle is having to chase payments. Constantly trying to get in touch with clients is no simple task, but with the help of automation or just using the right application, you can simplify your workflow and avoid some of the headache that often comes with the remote worker lifestyle.